Choosing between launching an original business and investing in a licensed franchise is one of the most strategic financial decisions entrepreneurs face in 2025. This detailed guide explores funding options, profitability metrics, investor perspectives, real-world examples, and risk management frameworks that determine long-term success. Discover how innovation and brand licensing intersect—and which path truly drives sustainable wealth.

Table of Contents

- Understanding the Funding Landscape in 2025

- What Are “Originals” vs “Licensed Franchises”?

- Key Financial Differences

- Startup Funding Sources Compared

- The Franchise Funding Ecosystem

- Investor Perspectives & ROI

- Case Studies: Successes and Failures

- Legal & Regulatory Framework

- Risk Factors & Cost Structures

- FAQs

- Takeaways, Expert Insights & Resources

Understanding the Funding Landscape in 2025

The business world in 2025 has dramatically shifted. Venture capital flows, private equity interests, and crowdfunding trends now play an increasingly decisive role in whether a startup can thrive—or a franchise can expand.

According to PitchBook (2025 Q2 report), global startup funding dropped by 19% year-over-year, while franchise sector investments grew by 11%—driven by predictable revenue and lower failure rates. This divergence highlights a fundamental funding dilemma for modern entrepreneurs:

“Should I build something from scratch, or buy into a proven system?”

What Are “Originals” vs “Licensed Franchises”?

Originals are independent businesses born from new ideas, innovative products, or untapped niches. They represent creative risk-taking and brand freedom.

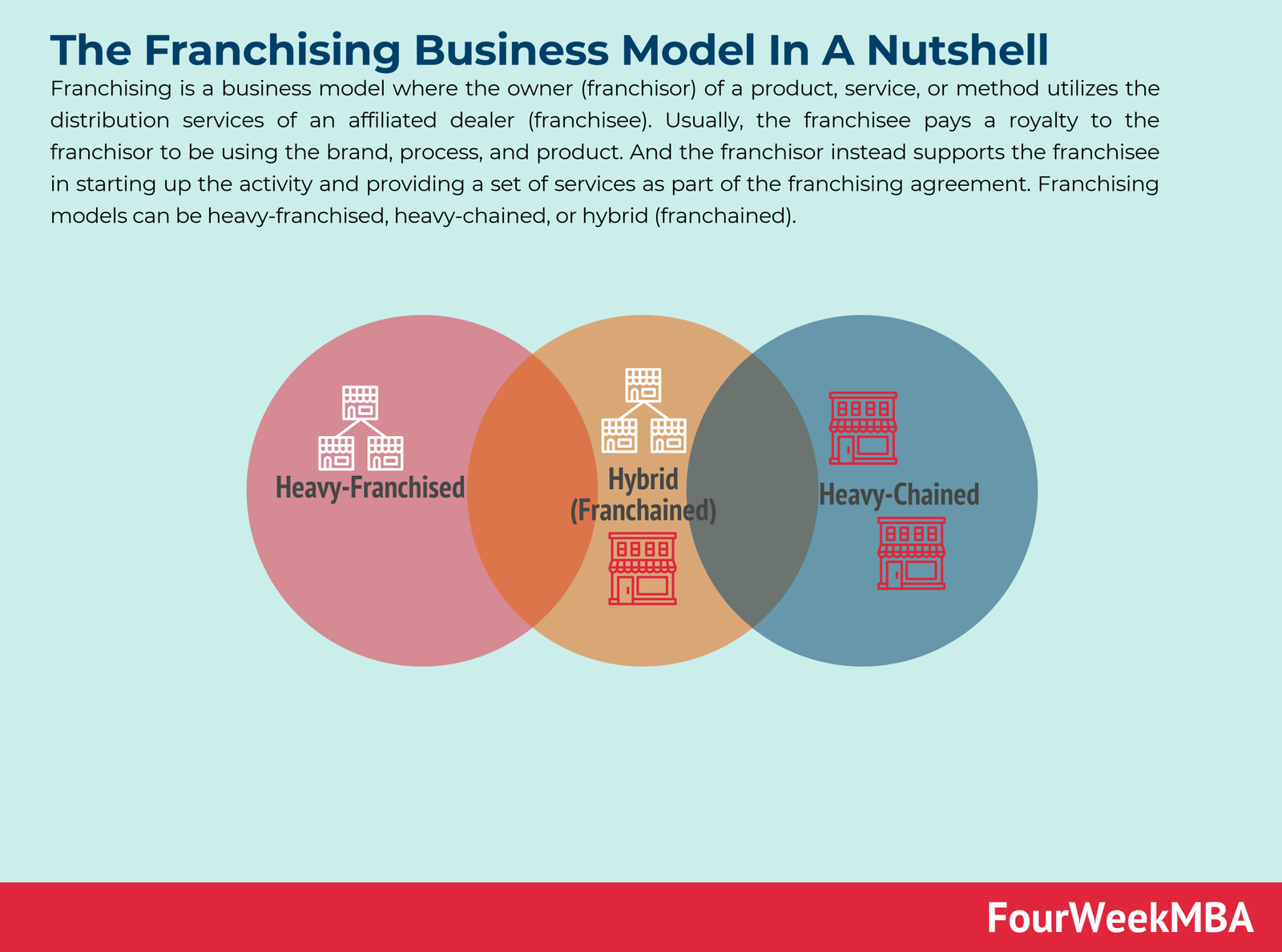

Licensed Franchises, on the other hand, are pre-existing business systems with a proven operational model—where entrepreneurs pay for rights to operate under a brand’s trademark.

In simple terms:

- Originals build from the ground up.

- Franchises buy into success that’s already structured.

Advantages of Building Originals

- Full creative and operational control

- Higher potential for innovation and scalability

- Long-term asset ownership and brand equity

- Freedom to pivot or rebrand without restrictions

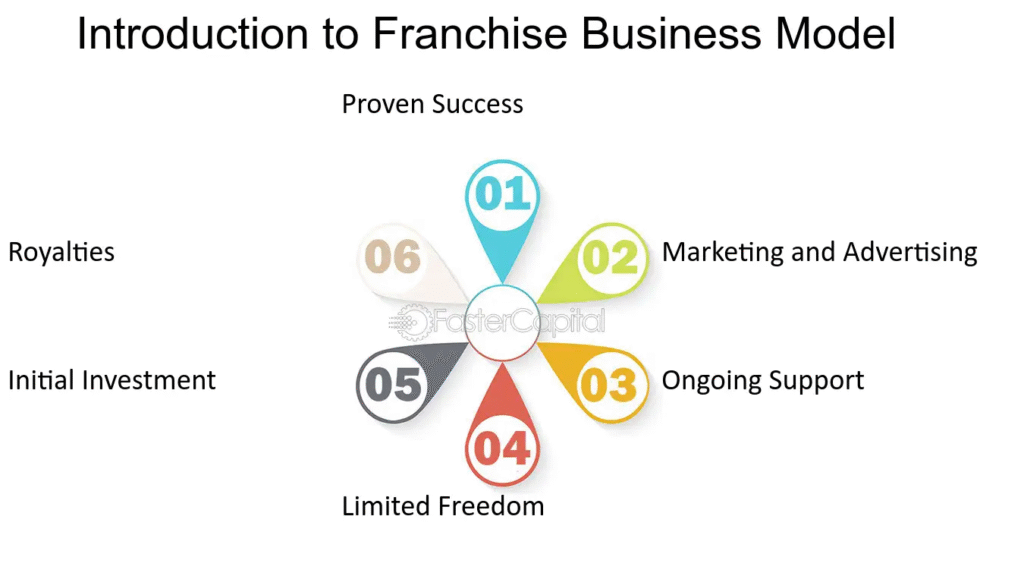

Advantages of Licensed Franchises

- Established brand trust and customer base

- Easier access to funding and loans

- Proven operational support and training

- Reduced marketing and R&D costs

Key Financial Differences Between the Two

The funding models differ drastically. Originals often rely on angel investors, bootstrapping, or venture capital, while franchises primarily use SBA loans, bank financing, or franchisor incentives.

| Factor | Originals | Licensed Franchises |

|---|---|---|

| Startup Cost | Varies widely; typically $100k–$500k | Fixed entry fees ($50k–$1M) |

| Funding Difficulty | High (no track record) | Moderate (brand backing) |

| Risk Level | High (market uncertainty) | Lower (tested model) |

| ROI Timeline | 2–5 years | 1–3 years |

| Profit Margin | Higher potential, volatile | Stable, predictable |

Stat Insight: According to the U.S. Bureau of Labor Statistics, nearly 45% of new businesses fail within 5 years, while franchise survival rates exceed 65%.

Startup Funding Sources Compared

Funding Originals

- Angel Investors – Early backers who believe in innovation.

- Crowdfunding Platforms (Kickstarter, Indiegogo) – Great for creative products.

- Venture Capital (VC) – Growth-stage funding, high control loss.

- Bootstrapping – Using personal savings; high autonomy, high stress.

Funding Franchises

- Small Business Administration (SBA) Loans – Lower rates for qualified franchises.

- Franchisor Financing – Brand-assisted funding with training.

- Bank Loans – Easier approval due to established brand reputation.

- Private Investors – Often prefer franchise predictability over startups.

The Franchise Funding Ecosystem in Detail

Franchises benefit from an established financing network.

The International Franchise Association (IFA) reported that 73% of franchisees received third-party financial support in 2024.

Key players include:

- Franchise brokers and advisors

- Lending institutions specializing in franchise models (e.g., BoeFly, FRANdata)

- Microloans through SBA 7(a) programs

Pro Tip: When using Rank Math, link out to credible franchise directories to build trust and domain authority.

Investor Perspectives & ROI Patterns

Investors Prefer Predictability in 2025

Due to the volatile economy, investors are drawn to stability and franchise-backed ROI models.

Franchises like Dunkin’, Anytime Fitness, and The UPS Store provide documented earnings, making it easier to attract lenders.

Originals Appeal to Visionary Investors

For risk-tolerant investors, originality equates to innovation.

Companies like Airbnb, Canva, and Warby Parker started as “high-risk originals” but yielded multi-billion-dollar valuations.

“The biggest risk in business isn’t failure—it’s following a model too safe to evolve.”

— Reid Hoffman, Co-founder, LinkedIn

Case Studies: Lessons from Real-World Successes

Case Study 1: Original — Warby Parker

- Started with $2,500 seed money.

- Disrupted traditional eyewear with direct-to-consumer pricing.

- Valuation (2025): Over $4 billion.

- Funding Journey: Venture-backed, gradual scaling.

Case Study 2: Franchise — Subway

- Grew rapidly due to global franchising.

- Initial franchise fee: ~$15,000.

- Franchisee ROI in 2–3 years (average).

- Challenge: Over-saturation lowered margins in later years.

Case Study 3: Hybrid Approach — Crumbl Cookies

- Original idea + Franchise model within 2 years.

- 1,000+ stores by 2024.

- Balanced brand control with franchise scalability.

Legal & Regulatory Framework

Launching either model requires compliance with federal and state regulations.

Franchise Legalities:

- Governed by the FTC Franchise Rule.

- Requires a Franchise Disclosure Document (FDD).

- Must adhere to trademark licensing, royalties, and operational consistency.

Original Business Legalities:

- Requires business registration, trademark filing, and IP protection.

- Varies by state and sector.

Note: Consult the U.S. Small Business Administration (SBA.gov) for current compliance checklists and legal templates.

Risk Factors & Cost Structures

Common Risks for Originals

- Market acceptance uncertainty

- Cash flow instability

- Team dependency and scaling challenges

Common Risks for Franchises

- High upfront franchise fees

- Royalties cutting into profit margins

- Limited creative control

Example: A McDonald’s franchise may cost $1.2M upfront but has 90% success probability.

In contrast, an original restaurant might cost $300k to start—but only 50% survive year one.

Trending FAQs About Funding Originals vs Franchises

1. Is it cheaper to start a franchise or an original business?

Franchises often have higher entry costs but lower operational risk. Originals can start smaller but face higher market uncertainty.

2. How do investors evaluate risk between the two models?

They assess cash flow predictability, brand recognition, and scalability. Franchises win on stability; originals win on innovation.

3. What are the most profitable franchise models in 2025?

Food delivery, healthcare, home services, and boutique fitness remain top-performing sectors.

4. Can I turn my original business into a franchise?

Yes! Once your model is profitable and replicable, you can register and franchise it—like Crumbl Cookies did.

5. Which funding source gives faster ROI?

SBA-backed franchises yield ROI within 18–36 months. Originals may take 3–5 years but offer higher equity.

6. What legal documents are needed to fund a franchise?

Franchise Disclosure Document (FDD), business license, and SBA loan documents are mandatory.

7. How do tax benefits compare?

Franchises enjoy deductions on franchise fees and royalties; originals can claim R&D credits and innovation grants.

8. What’s the biggest reason startups fail?

Lack of funding and poor market fit. 82% of startups fail due to cash flow mismanagement (CB Insights).

9. Can I fund both models simultaneously?

Yes, through hybrid ventures—like launching an original brand and franchising its sub-models.

10. Which model is better for the long term?

If you value control → Original.

If you value stability → Franchise.

If you value scalability → Hybrid.

Key Takeaways & Expert Insights

- Franchises are safer for first-time investors seeking structured systems.

- Originals suit visionaries looking to disrupt industries.

- Hybrid approaches are emerging as the future of business funding.

- Always conduct ROI modeling before capital investment.